In a recent federal court filing, Zurich American Insurance Company asked the district court to ignore the entirety of science regarding COVID-19 in order to support Zurich’s denial of all coverage for COVID-19 business interruption losses.

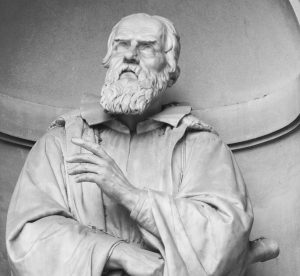

Western civilization has a long history of choosing superstition in favor of science. In the early 1600s, Galileo was threatened with torture and put under house arrest for the rest of his life for demonstrating that the earth moves around the sun. Later in the 1600s, the Salem government hanged women for being witches. In each of these examples, religion and superstition challenged science in ways no one seeks to justify any longer.

In the case of the 2020-21 spread of the novel coronavirus and the resulting COVID-19 pandemic, there are those who deny its existence, and much debate over how best to respond to it. At the same time, in the United States, there have been more than 33 million COVID-19 cases resulting in over 590,000 deaths.

The novelty of Zurich’s effort is not that it takes a position on which scientific reports are correct. Zurich asserts no religious objection or superstition. Instead, Zurich seeks a legal ruling to prop up its blanket coverage denials of what appears to be all COVID-19-related losses. Facing an irrefutable mountain of scientific studies all supporting coverage, Zurich moves to strike scientific information from the complaint. Zurich does so on the basis that otherwise it would have to “respond to” and “investigate” what it mischaracterizes as “internet hearsay.” In short, Zurich complains that if the court is allowed to consider the science of the novel coronavirus, Zurich will be required to actually read and investigate scientific studies from the likes of the Centers for Disease Control, World Health Organization and the New England Journal of Medicine. In this regard, Zurich seeks a novel exception to its statutory obligation to investigate insurance claims.

Policyholder Pulse

Policyholder Pulse