The Illinois Supreme Court has teed up a significant insurance question: Does a standard pollution exclusion bar coverage when the alleged “pollution” was not considered to be pollution when the policy issued—where the substance was lawfully emitted under an environmental permit?

The Illinois Supreme Court has teed up a significant insurance question: Does a standard pollution exclusion bar coverage when the alleged “pollution” was not considered to be pollution when the policy issued—where the substance was lawfully emitted under an environmental permit?

The court accepted a certified question from the Seventh Circuit on April 17, 2025, in Griffith Foods International Inc. v. National Union Fire Insurance Co.—a case that springs from the Sterigenics ethylene-oxide suits. The court’s agreement to consider the question signals the potential for a landmark ruling on the scope of pollution exclusions, with far-reaching implications for companies dealing with environmental and related toxic tort claims.

Policyholder Pulse

Policyholder Pulse

In August, we provided an

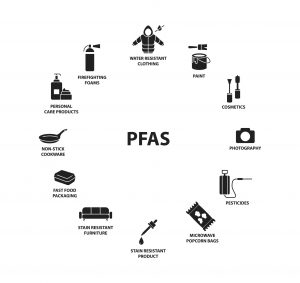

In August, we provided an  A key component of a company’s risk management function is to keep a close eye on new and developing sources of liability and to put in place appropriate insurance to respond in the event those liabilities ripen. In recent years, there has been a significant increase in legal and regulatory attention on per- and polyfluoroalkyl substances, more commonly known as “PFAS” or “forever chemicals.” PFAS are used in countless applications, and many companies across the country bear potential liability, from chemical companies to manufacturers to retailers to corporate end users. PFAS-related enforcement is focused on remedying impacts to both the environment and human health. Importantly, a company’s liability for PFAS-related contamination or bodily injury may be covered under historic general liability policies and/or modern-day pollution liability policies. As regulation and litigation relating to these ubiquitous substances continues to surge, corporate policyholders with potential exposure should be proactive to examine their insurance portfolios and position themselves for potential insurance coverage in the event they become a PFAS liability target.

A key component of a company’s risk management function is to keep a close eye on new and developing sources of liability and to put in place appropriate insurance to respond in the event those liabilities ripen. In recent years, there has been a significant increase in legal and regulatory attention on per- and polyfluoroalkyl substances, more commonly known as “PFAS” or “forever chemicals.” PFAS are used in countless applications, and many companies across the country bear potential liability, from chemical companies to manufacturers to retailers to corporate end users. PFAS-related enforcement is focused on remedying impacts to both the environment and human health. Importantly, a company’s liability for PFAS-related contamination or bodily injury may be covered under historic general liability policies and/or modern-day pollution liability policies. As regulation and litigation relating to these ubiquitous substances continues to surge, corporate policyholders with potential exposure should be proactive to examine their insurance portfolios and position themselves for potential insurance coverage in the event they become a PFAS liability target. There has been a drumbeat of

There has been a drumbeat of  Pennsylvania recently issued a ruling in an insurance case that, like Flint, related to alleged contamination in drinking water stemming from corroded pipes. The decision rejects two insurers’ attempts to avoid coverage and serves as a good reminder of some fundamental insurance law principles—the duty to defend is broad, ambiguous policy language usually is construed against the insurer, and policies should be interpreted in favor of their purpose to provide coverage. It is also a reminder that the pollution exclusion is not nearly as all-encompassing as insurers like to think it is.

Pennsylvania recently issued a ruling in an insurance case that, like Flint, related to alleged contamination in drinking water stemming from corroded pipes. The decision rejects two insurers’ attempts to avoid coverage and serves as a good reminder of some fundamental insurance law principles—the duty to defend is broad, ambiguous policy language usually is construed against the insurer, and policies should be interpreted in favor of their purpose to provide coverage. It is also a reminder that the pollution exclusion is not nearly as all-encompassing as insurers like to think it is. Thus, it is imperative that contractors have the right pollution coverage in place to remain secure and profitable.

Thus, it is imperative that contractors have the right pollution coverage in place to remain secure and profitable. easingly bringing nuisance claims based on bright lights, loud noises, traffic, dust, odors, wastewater and other effects of these activities. A question facing the oil and gas industry is whether the costs of such nuisance claims are covered by insurance.

easingly bringing nuisance claims based on bright lights, loud noises, traffic, dust, odors, wastewater and other effects of these activities. A question facing the oil and gas industry is whether the costs of such nuisance claims are covered by insurance.